General Thesis

A brief overview of how we think about navigating the crypto market.

I will attempt to condense years of thoughts and intuition into few pages - I’ll be simplifying most concepts in order to get the gist of my thinking across. The following will be a high level overview of how we think. As an overarching theme, we blend behavioural economics, reflexivity, the idea that narratives drive prices, and data in order to make sense of the market. It’s worth noting that we think like traders and we construct our book like traders, we are not long term investors.

—

Basic Premise - Survive

As a guiding light, the importance of prioritising survival cannot be overstated. This is the primary rule, everything else is secondary. A vast majority of projects in this space fall to the wayside, their native asset might have a good few months in a bull market, but we all know of projects that died in the depths of a bear market - never to return. The probability of any one coin making new highs (denominated in majors) is near zero, this makes picking winners a challenge. Fundamentally, we think this is a function of an attention economy as well as the sheer number of new projects in the space. The supply of new tokens will always outstrip demand.

The need to survive is everything, this space dies and comes back to life faster then we all think - taking risk off in the euphoria of a bull market such that you have capital to deploy in the depths of a bear market will pay infinitely more than making dogmatic investment decisions with 10 year time horizons. Nobody knows how this space will evolve and what projects will exists in the years to come, it’s naive to think otherwise.

Given our objective function is to survive, this informs how we construct our book. We run two seperate books, an investing book and a trading book - I’ll elaborate further on how we think about investing in the Asset Selection section, and trading in the Meta Game section. As a general overview - we take high conviction, concentrated bets on the investment side of things, our time horizon is 1 cycle. On the trading side of things, we will punt anything that we think has an asymmetric risk profile - we don’t have specific time horizons.

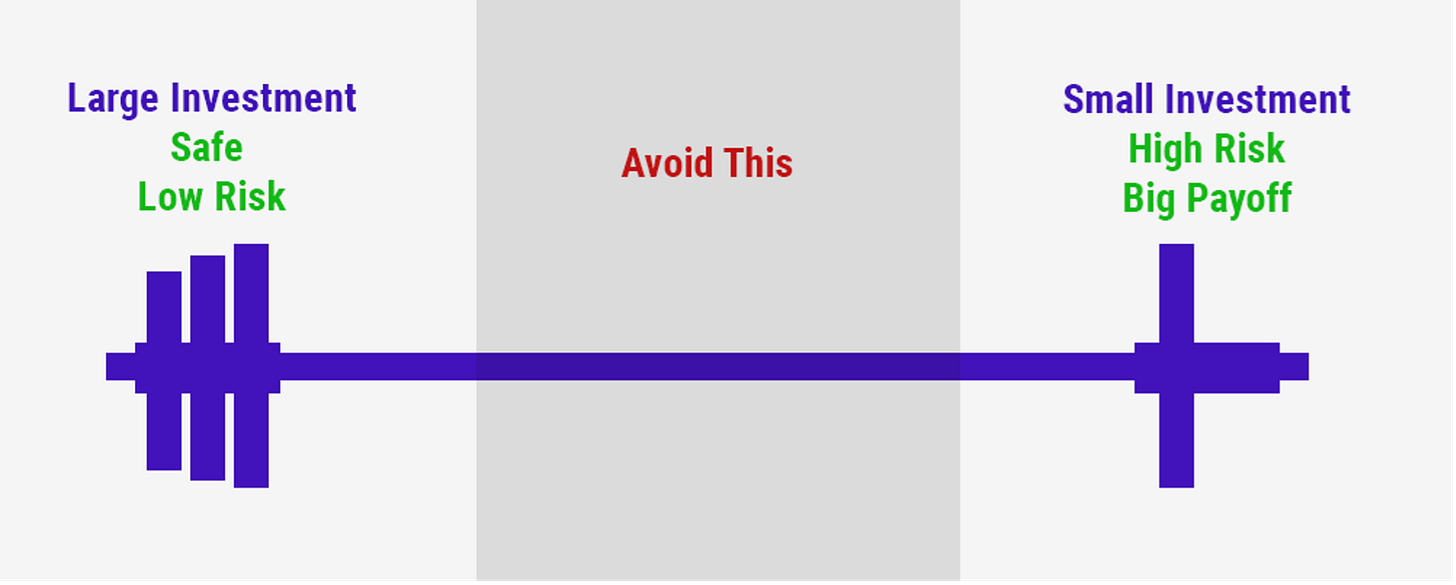

We believe in a barbell portfolio construction - pictured below. Given our objective function, putting 85% of the book in low risk bets ensures survival, while we aim to juice returns through more risk-on trades.

—

The Risk Curve

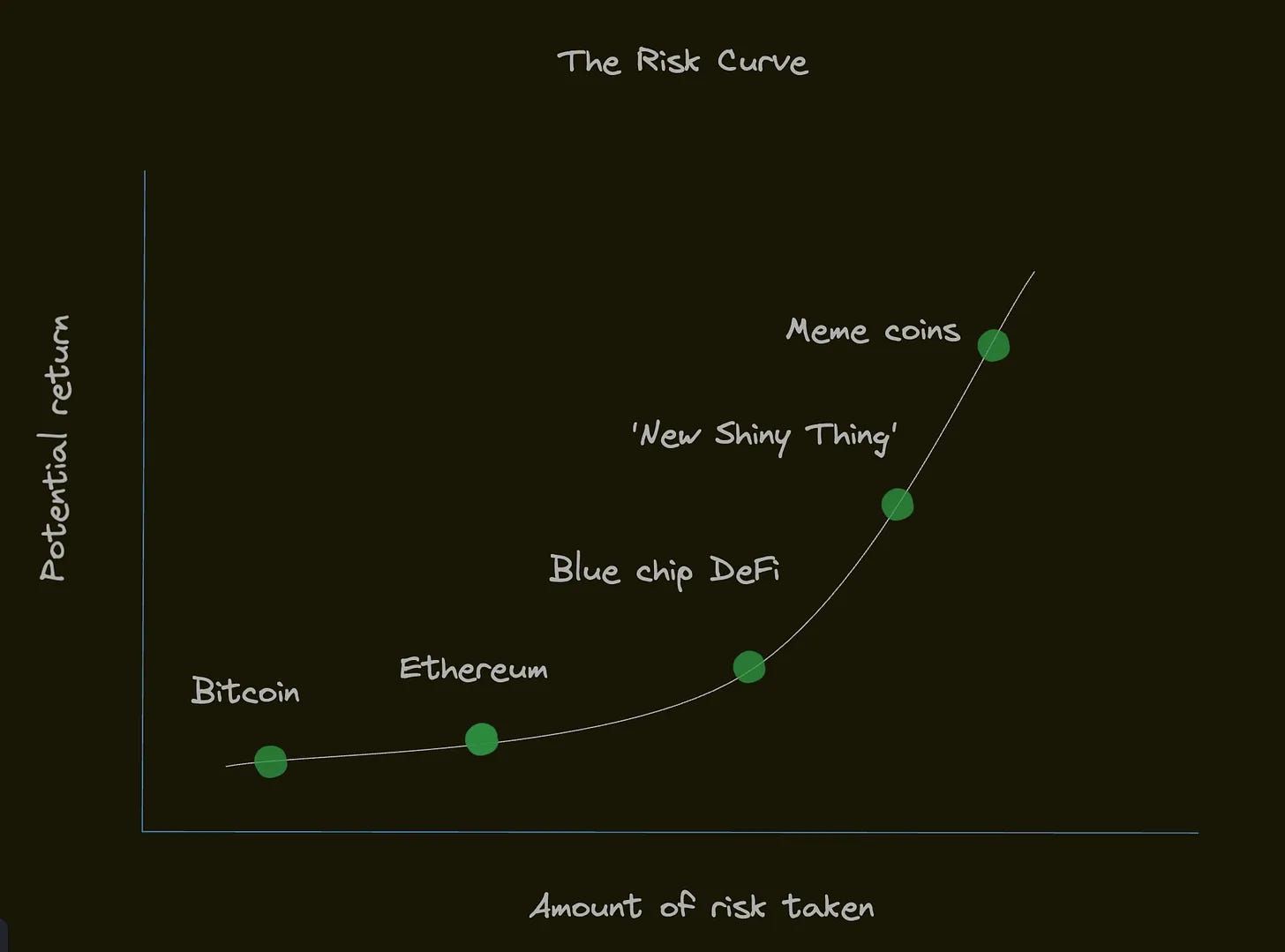

In order to understand what fits where in a barbell portfolio, it’s important to have an idea of what a theoretical risk curve looks like.

Some thoughts on risk, generally

I’ve sat through upmteen lectures on risk, and the process around diversifying it away - all these ideas were predicated on notions of Efficient Market Hypothesis (EMH). We think of market efficiency on a scale, not a binary outcome - TradFi markets are far more efficient than crypto markets.

We don’t believe in diversification, we believe in concentration.

When it comes to risk in crypto markets, we have yet to see a compelling thesis for a diversified book. The reality is that that everything is levered beta to BTC, and to a lesser extent, ETH. In the bull market, correlations may disperse, but on the way down, correlations converge. Perhaps you could argue for diversification across themes - DePIN, Crypto x AI, Smart Contract platforms, etc. It’s an idea we’ve entertained, however we prefer to take concentrated bets on assets that have demonstrated a compelling schelling point and network effect.

A Theoretical Risk Curve

So if we don’t believe in diversifying risk away, how do we think about risk?

Generally speaking, at different parts of the market cycle, one should be allocated to different parts of the risk curve. It’s helpful to have a theoretical idea of if we are playing a zero-sum, negative-sum, or positive sum game.

—

A general outline of how capital flows around the market throughout a market cycle:

> Depths of a bear market → BTC and ETH catch a bid, outperformance. This kick starts a bull run (zero-sum)

> Early stages of a bull market → Allocators rotate out into blue chip beta, this includes blue chip DeFi and the ‘new shiny thing’ (slightly positive-sum)

> Late stages of a bull market → Euphoria. Dumb money arrives and allocates to anything and everything that goes up - we are now playing very far out on the risk curve (positive-sum)

> The parabola cracks, the music stops and the game is over. The tail end of the risk curve sells off immediately, most will never recover. Capital leaves the asset class. Majors begin to drift lower (negative-sum)

At all points in time, knowing the sum of the game we’re play helps inform asset selection. I.e., it doesn’t matter how interesting a new project is in the depths of a bear market, there’s no use in allocating as it is unlikely to display relative outperformance. The time to allocate to ‘the new shiny thing’ is in the middle → end of the bull market. This is a function of the wealth effect.

Coming back to the idea of survival, It is of the utmost importance to know which part of the risk curve to play on at each point in time, where the relative outperformance will be found, and when to leave the casino. The need to survive should inform asset selection, relative weightings, and risk tolerance.

Bearing in mind that allocating to spot is akin to doing liquid venture capital where projects are trading at absurd valuations, this is not the place to build a book for the next 10 years.

—

Thinking about Assets

Strong convictions, loosely held.

Bayesian inference is a key building block in the land of discretionary asset selection, especially given the dynamic nature of news, narratives and price. We believe in the assets we allocate to, but we are always taking in new information and making adjustments. We are willing, at all points in time, to sell everything or double down.

Part 1: Qualitative vs Quantitative analysis:

As a general rule of thumb - the earlier stage an industry is, the more one should use qualitative metrics (as opposed to quantitative), when looking to understand how these assets behave.

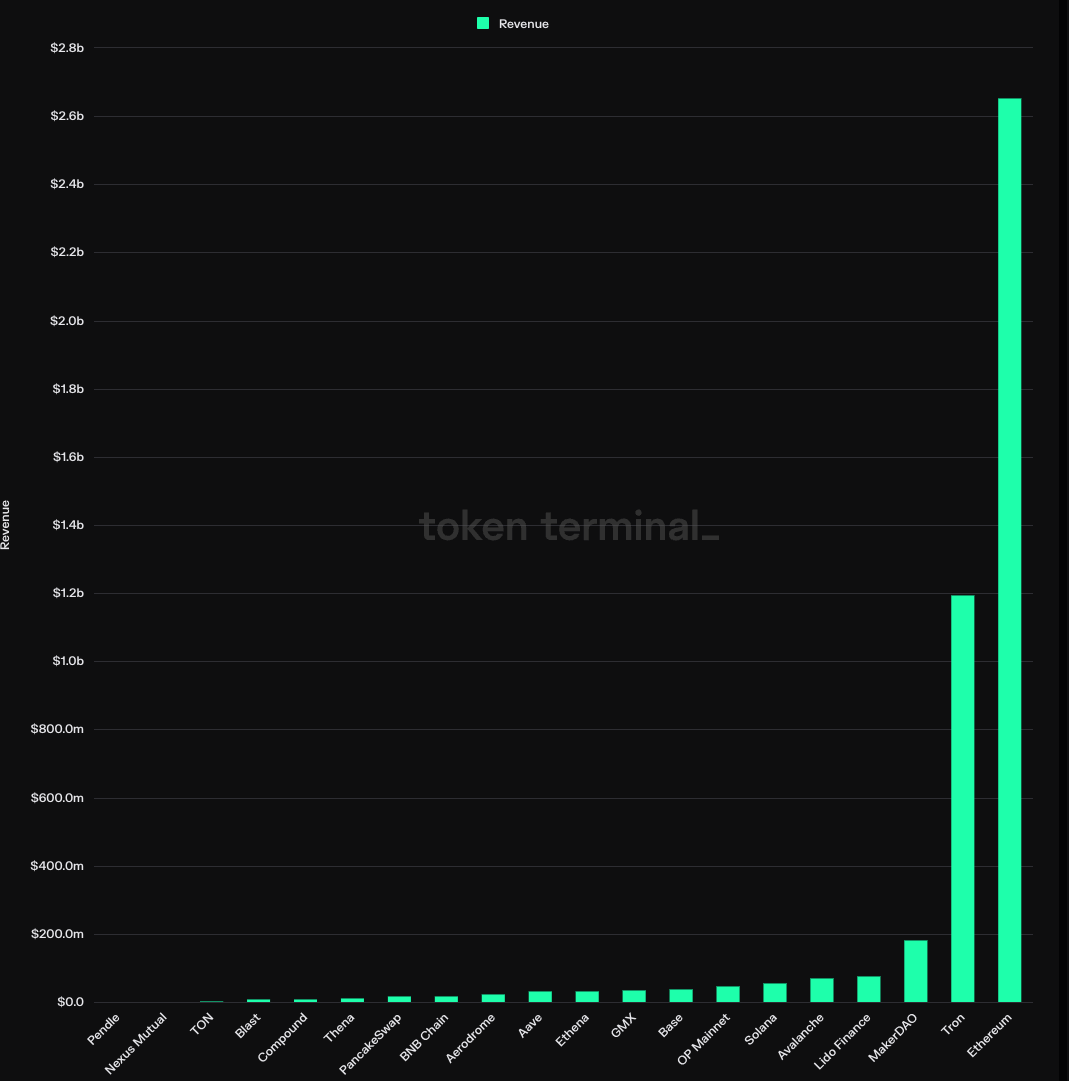

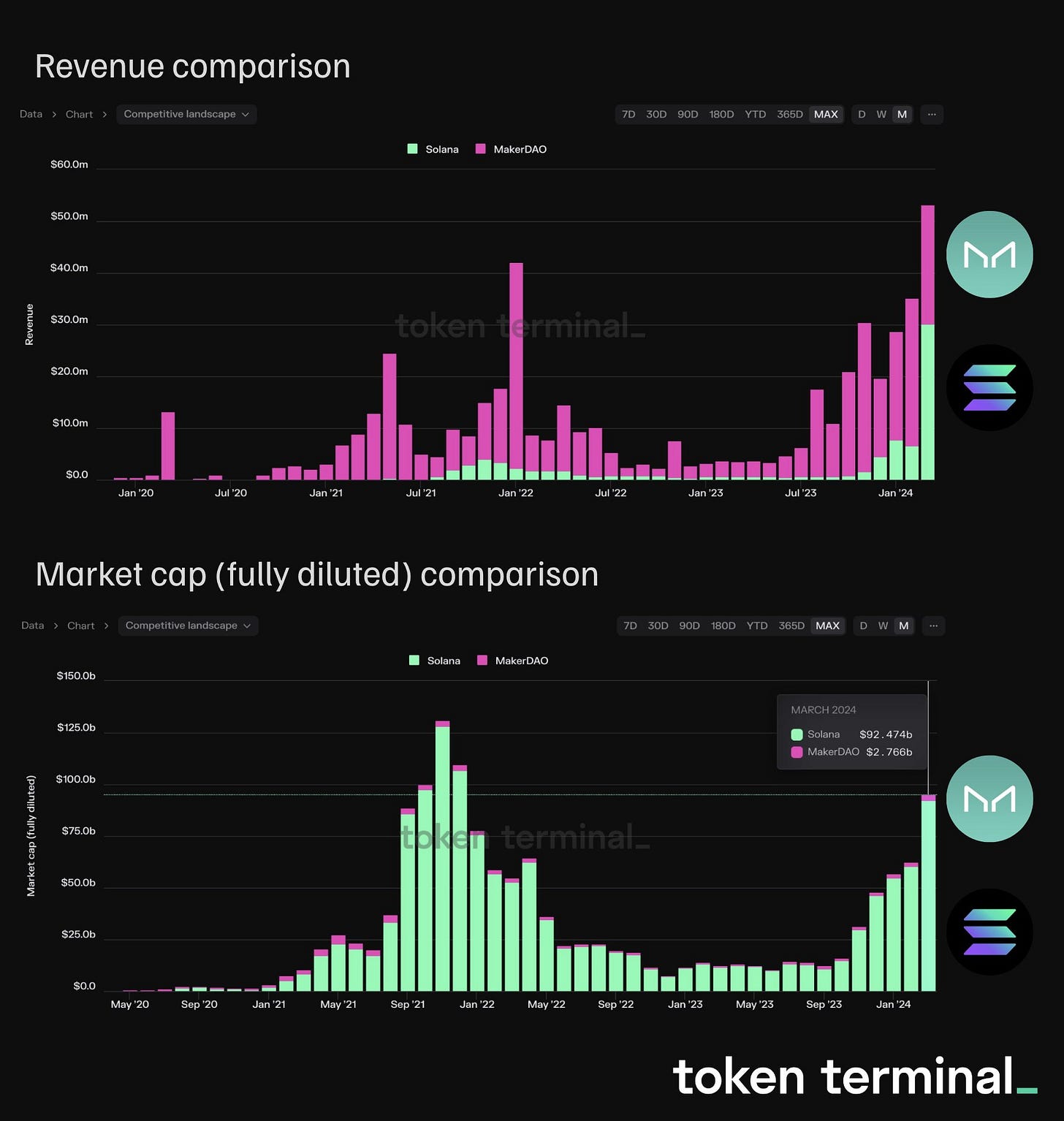

When looking at a mature stock trading on the SP500, you should have a detailed understanding of how the numbers look, how a change in X variable changes the DCF and how this might affect price. However, borrowing this framework for crypto does investors no service - a prime example of this is MarkerDAO ($MKR) vs Dogecoin ($DOGE). MarkerDAO spits off $200m in yearly revenue, has the 3rd highest top line of all crypto assets, the highest of any application - but is ranked #47 by MCap. Where as doge is a pure memecoin, but is ranked 9th by MCap - it’s only value is memetic.

This simple example illustrates the utility of qualitative analysis. Things like community and the story we tell ourselves are far more important than cash flows or fundamental metics.

Part 2: Behavioural components

Understanding qualitative markers such as human behaviour serve as a useful tool when thinking about which projects will do well, on a relative basis. One of the most poignant is the idea of a unit bias - take 2 identical projects, project 1 trades at $0.1 while project 2 trades at $100, assume these two projects have the same market cap and FDV. It’s reasonably safe to assume that the token of project 1 performs far better than the token of project 2, because of a low unit bias. A good example of this is Bittensor ($TAO), an innovative project sitting at the intersection of Crypto and AI - but the project trades at a price of $500+, this is bordering on a deathblow for future price appreciation.

Above is another comparison that makes a similar point - Solana and MarkerDAO have similar revenues, but the market cap of SOL is 34x bigger than MakerDAO. The funny thing is that a spread trade of long $MKR against $SOL on the basis of a perceived mispricing will ultimately get blown out. As a reminder, we are not allocating to fundamentals - we are allocating to coordination points.

On a more general note, our job is that of a judge in a Keynesian beauty contest - we allocate to assets that the market will, on average, allocate to. Not the ones we think are the best. Understand who your counterparties are, and how they are thinking.

This ties back into the idea of a community and the story we tell ourselves about an asset - what is the narrative around this asset? are we telling each other a compelling story? How strong is this assets coordination point?

—

Speculation as a bootstrapping mechanism

One of our more unpopular opinions about this space is that there is very little we have solved as far real world problems, and we haven’t built much that is useful to the man on the street. Next time you are around friends, ask who has used ChatGPT and who has used crypto - suffice to say that ChatGPT solves real problems, today. Can we say the same about crypto? Bar a select few solutions, all we have done is created the worlds most accessible casino. We have built CEXs (speculate on prices), DEXs (speculate on prices, with a hint of decentralisation), CDPs (borrow against your assets and speculate), NFT trading platforms, derivatives galore, liquid markets for points systems, and numerous other tools to speculate.

Came for the money, stayed for the tech.

However, there is nothing wrong with this - speculation as bootstrapping mechanism is a good way to go about it. We can do intellectual gymnastics about why [inset token here] has PMF, but the reality is that we are still speculating on weather monolithic or modular architecture is the best design for a L1 - or perhaps all apps will run on their own chain. My point is simple, speculation is how we, as market participants, express our views on the future of the space - it’s important to remember that there is no nobility in dogmatic viewpoints, look where it got the BitcoinCash people. Our objective is to increase the value out of our book, not make investments based on philosophical beliefs.

I believe that one day we will have true PMF, and in some ways we already do - but on the way there, it’s important to understand that we are playing a coordination game. Fundamentally, I believe that we don’t have a solid demand side (organic/price agnostic demand) - we have umpteen new projects promising to be the future of finance, but the only real source of demand is the desire to speculate.

Cavet:

It’s important to point out that there is some projects/verticals have demonstrated organic demand. Bitcoin, Ethereum, and Solana have demonstrated clear PMF, this needs no explanation. Other verticals that have begun to demonstrate PMF are the intersection of Crypto and AI, DePIN, and stablecoins.

—

Asset selection

Given we think this market is priced on speculation - how do we use qualitative markers and behavioural economics to select assets for our spot portfolio. We hold BTC, ETH, and SOL in our spot book, these are all cycle long bets - the relative weightings have, and will, differ at different points in the cycle.

The biggest thing that matters from a qualitative point of view is the story underpinning the asset - how compelling is the narrative? How compelling a narrative is determines the strength of the coordination point, upon which we then build a network effect. Network effects are the real end game - without them, projects die.

BTC: finite supply, commodity theory of money, PoW, back bone of the ecosystem, hypermonitization, SoV thesis - hard money pitted against fiat, this is a compelling thesis.

ETH: first prominent L1, internet bond, settlement layer for the IoT, ulta sound money - it’s size has allowed it to build a strong network effect, this acts as a moat.

SOL: retail chain, high throughput and low fees (massive TAM), Alt L1 trade (rd. 2), good memes, etc. SOL v ETH - the trade one puts on to express apathy toward ETH. It’s design trade offs make it a good candidate for the most widely held asset - it’s the L1 majority of retail will use to speculate.

Lindy effect - BTC > ETH > SOL, other projects might have been around longer, but these three have been around the block and captured significant mind share. A common theme across all the assets is that of culture and a strong community that acts as moat - these are unforkable characteristics. They are material parts of ‘the crypto conversation’, thus we can assign a high probability to reasonable price appreciation as well as their long term existence.

I’d like to dive into BTC quickly as I think it’s the most interesting project/idea in the space. BTC is an entirely different asset to the rest of the market - there exists no competitors to the BTC throne, where as everything else has viable competitors. BTC is the only large PoW network, thus those who secure the network are not (necessarily) the holders of the token - at least in the same way that PoS chains are, this allows for a more diverse ecosystem. Governments can now do multi decade, billion dollar infrastructure projects assuming Bitcoin exists in perpetuity. In a woke capitalism vs e/acc world - BTC is positioned as the clearest rallying cry for the GOP/conservative establishment. There are umpteen permutations of prisoners dilemma esque nation state adoption futures that will play out. There exists a future where a government’s position on BTC (and crypto more broadly) becomes a one issue vote - in the same manner gun laws are. The backward induction of the future voting blocs position on crypto can been seen already in the way politicians are conducting themselves. It remains the most fascinating intersection of finance and behavioural economics we have seen to date. There are no other crypto assets that have both economic and political angles to it.

Beyond BTC, ETH, and SOL - we struggle to make a coherent cycle long investment thesis for anything else. Yes, there are many interesting projects - but we view these as trades, not cycle long investments.

It’s important to compartmentalise trading from investment - failure to do so will result in thesis drift and will ultimately materialise in losses. We invest in BTC, ETH, and SOL with a cycle long time horizon - these are not trades.

—

Trading the meta-game

Now that we have covered the investment side of things, it’s time to unpack the fun stuff - how we think about trading these markets?

There are no rules, there is no framework - there is only bayesian inference.

The metagame is an idea popularized by Cobie in his 2021 article. It was a pivotal moment in how we think about navigating the space, I highly recommend giving it a read. Let’s unpack it.

We think about the meta games as the set of rules/heuristics governing how market participants trade. It is a strategy game in which the rules are constantly evolving - players are rewarded for identifying the ‘current thing’ early and extracting value. This is a layer removed from investing, it’s far more abstract and esoteric - indulge me as I make some hand wavy statements.

The basic premise is as follows - there is an underlying mechanism that drives a certain behaviour in the market. The underlying mechanism can be a new protocol upgrade, predatory tokenomics, a solution to a problem, changing market participants, an innovation, etc. These changes, in conjunction with market participants view on them, is the underlying mechanism that drives changes in both behaviour and price. The behaviour of both market participants as well as price is reflexive, I hope you’re all familiar with the work of George Soros and his book ‘The alchemy of finance’.

Participants identify the underlying mechanism → They play the game → The price behaves in a manner conformant to the rules of the game → The game becomes more obvious → More participants identify the underlying mechanism → Additional players enter the game → etc.

Hopefully I’ve made the feedback loop clear, let’s look at some previous examples of meta-games.

Example 1: The ETH killer trade

This was the trade of the ‘21 bull run. The premise was as follows: the ‘21 bull run was fueled by ZIRP, stimmy checks, and lockdown - retail wanted to speculate on crypto. They went to speculate on ETH main chain, transaction fees were we’re prohibitivly expensive and ETH scaling solutions were insufficient. Thus, alternative layer 1s became hot property as they offered low fees and high transaction throughput. This was the underlying mechanism - SOL + AVAX > ETH, alternate layer 1 were a solution to the ETH problem. The net result of this was massive price appreciation in the native tokens.

Example 2: The Merge trade

As ETH transitioned from PoW to PoS, there was a hard fork - this meant that the chain would split and there would be 2 tokens. Participants looked at this and bought spot ETH, some hedged this exposure with perps and held into the fork in order to collect the new token. The underlying mechanism was participants putting on the long ETH trade with the goal of collecting the forked token and the result was isolated outperformance in ETH.

Example 3: Crypto x AI

This is a meta-game that is currently live. ChatGPT was released, participants were exposed to the power of AI, NVDIA beats earnings estimations over and over again. OpenAI is a private company, NVDIA is pricey + out of reach for most participants - the result is a massive speculative bubble at the intersection of Crypto x AI. The underlying mechanism is the desire to express a bullish view on AI, the result is that tokens at the intersection of crypto and AI have outperformed.

Example 4: Memecoins

Perhaps the most obvious example of the irrational exuberance that exists in our market. Meme coins can be thought of as a social lottery - it’s like a regular lottery, but it’s internet native, has a dynamic PnL, and in a world of financial nihilism - why not gamble on something worth nothing. Knowing this, it also makes for one of the most obvious trades, long meme coins to express a view that retail is here to gamble. The underlying mechanism is retail likes to gamble, they tend to do so through memecoins and this makes meme coins a proxy bet on retail participation.

—

We throw words like parallelized EVM, restaking, enshrined rollup, data availability, and many other esoteric concepts around. The reality is that there are less than 100 people who could accurately deliver a coherent explanation of any of these topics. This market is unsophicated, participants tend to like things that are new, shiny and have a endearing story behind them. Each meta-game is comprised of different participants, underlying mechanisms, and rule sets - our job is to identify these parameters and extract value.

As a reminder, this is how we think about trading these market, these are not investment theses. The crux of the game is to rotate in, extract value, and rotate out. Trading the meta-game is a good way to grow your book, add upside volatility, and participate in some of the ‘ponzinomics’ on offer.

—

Ancillary thoughts

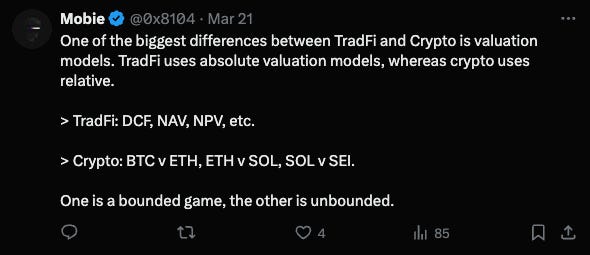

Valuation Models:

Valuation models can be broken down into absolute and relative models - absolute models value the asset in isolation (S2F), while relative models value the asset against other similar assets.

We don’t believe in absolute valuation models, we strongly believe in relative valuation models. Intersubjective value - ETH contends to the BTC throne, thus is valued against it. SOL contends to the ETH throne, thus is valued against it. WIF contends to the DOGE throne, etc. This is why we hear talk of ETH flipping BTC, SOL flipping ETH, WIF flipping DOGE, et cetera. More interestingly, this allows for an unbounded game, where as absolute valuation models are a bounded game. It’s important to think is relative terms, if your valuation model doesn’t make sense, you’re probably thinking in absolute terms or using quantitative markers.

Valuing these assets against one another is the most accurate way to understand mispricings and relative value. Most of these projects release tokens and trade at $10b+ valuations before they have a working product, or have demonstrated PMF - does this make them over valued? not necessarily.

On a more general note, what is the value of open source software that brings financial inclusion to anyone with an internet connection? Nobody knows, but suffice to say that using an absolute valuation model isn’t going to accurately price a mega-political force.

Always be long convexity:

This is a heuristic we use when thinking about capital allocation and trading. The idea of convexity is simple - does this investment, or trade, offer asymmetric upside? As a base modus operandi, it never pays to ‘diddle in the middle’ - a good example of this is our position in Solana - we bought a large amount in the $20 - $25 range. The convexity aspect of the thesis was simple, SOL was the darling of the last cycle, it didn’t die in the bear market (despite all that was thrown it’s way) and it’s 90% down from ATHs - looks pretty asymmetric to me.

Being long convexity is analogous to being long volatility, in the same way being short convexity is analogous to selling volatility.

Coming back to bayesian inference, the same logic applies to downside risk - if the market is in the late stages of a bull, perhaps the convex trade is selling/shorting. Being long convexity is allocating to trades/investments that offer much much high upside than downside - this makes bankroll management naturally easier.

—

Concluding thoughts

Hopefully this piece gave the reader a high level overview of how we think about crypto markets in general, and more specifically how we think about investing and trading these markets. I hope I’ve shed some light on how we use game theory, behavioural economics, narratives, and data to navigate the markets.

In the coming months, I’ll elaborate on our investment thesis for BTC, ETH, and SOL. For now, suffice to say that we’re extremely bullish the space - but at all times, we tread with caution.

Midas Capital.

ممنون ازت